Previously, I have talked about Lannett (NYSE: LCI) from following perspectives:

1.

Industry overview:

The generic pharmaceutical market overview

2.

Previous growth strategy:

Lannett, a mini-version of Valeant?

3.

Future projections:

Will Lannett lose another customer?,

Lannett's C-topical story,

The Lannett and JSP story,

Controlled substance - Lannett's hidden growth engine

4.

Valuation:

The valuation on Lannett

After so many moving parts, we currently conclude that LCI is undervalued (

bear case valuation at $20 per share).

Investment theses:

- LCI is currently undervalued due to market sentiment

- High-margin, high-barrier controlled substance business has been overlooked by the market

- LCI can generate sufficient cash flow to deleverage, even in severe pricing environment

#1) The big picture

Personally, I don't really like generic pharmaceutical industry. No offense to hardworking and smart management in the industry, but I purely think this industry is a malformation of market inefficiencies and regulation constrains.

If we use some imagination, we can see

this whole industry wiped off, if the government mandates brand drug companies lower the drug price after their patent cliff. Then there will be no hassles, no ANDA, no trials in court between brand drug companies and generic ones...

Furthermore, the growth and prosper of

personalized drug will reshape current pharmaceutical industry, and I don't see generic pharma with limited R&D investment can survive this reshaping.

What's a future of generic pharmaceutical industry?

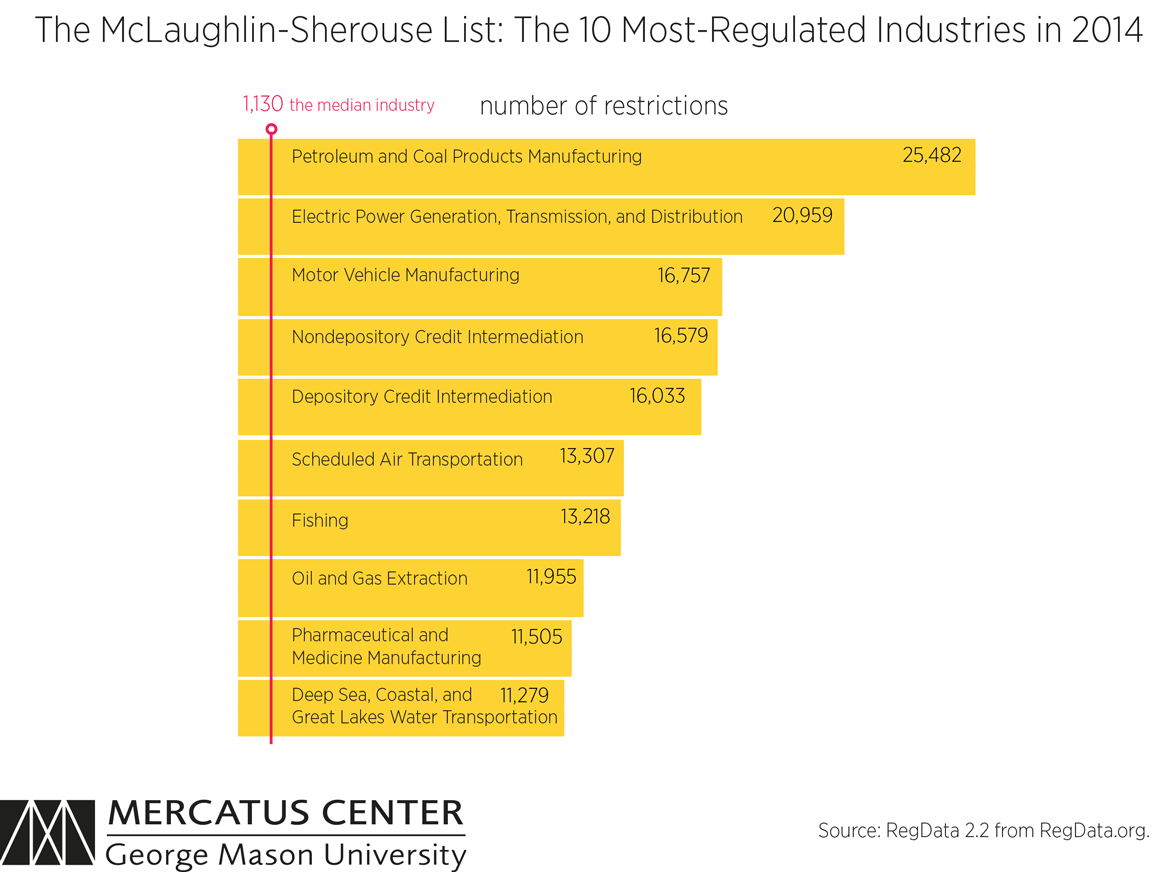

If we look at the most regulated industries in the US, like in the photo below:

What patterns do you see?

I see

consolidation. Only big players can survive the costly compliance procedures and argue with the government.

We also joked that FDA should a great investment, since the

compounded annual growth rate of Prescription Drug application free has been

14.11% for 24 years. In FY 2016, the fee is $2,374,200 for an application with “clinical data” requirement.

LCI is a small and beautiful company, but it will probably get into the consolidation swirl in the near future.

As a result, although LCI is mispriced, I am looking for a trade, instead of a long-term investment.

#2) Time-frame

In the valuation part, I have focused on the bear case valuation. Potential upside catalysts are as followed:

(This graph is outdated after 3Q16 earning call. Need to update)

(Source: complied by the author)

If we look for tools with the most skewed pay-off curve (an instrument that can provide significant upside reward),

Long-Term Equity Anticipation Securities ("LEAPs") seem to be good options.

#3) More questions

It's worth mentioning that there has been strong short interest hovering LCI since 2015. The current percentage of share shorted is ~30%.

So far I have considered following reasons for this strong short selling bet:

1. LCI can't handle its transformational acquisition and go bankrupt

2. LCI's business has fraud - e.g. channel stuffing to wholesale distributors and retail drug chains

3. Potential legal issues and product downgrade

4. CEO's health condition (currently age 70)

For (1), I see minimal chance of LCI going bankrupt, since its leverage ratio is 3.8x Net Debt/EBITDA, in line with the pharma industry average.

For (2), while we can cross check with Total Number of Prescriptions (TRx) from IMS, some field researches are still needed.

For (3) and (4), I haven't found material disclosures so far.

More importantly, I still don't understand why LCI didn't walk away from the KUPI deal when there was no break-up fee. It's potentially a fatal red flag.